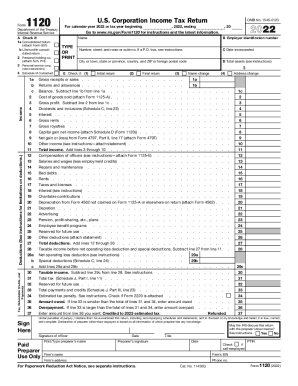

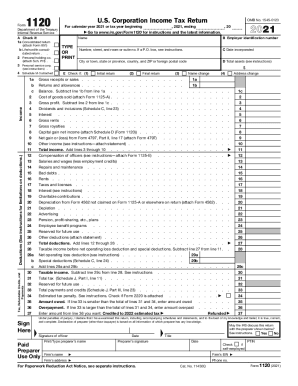

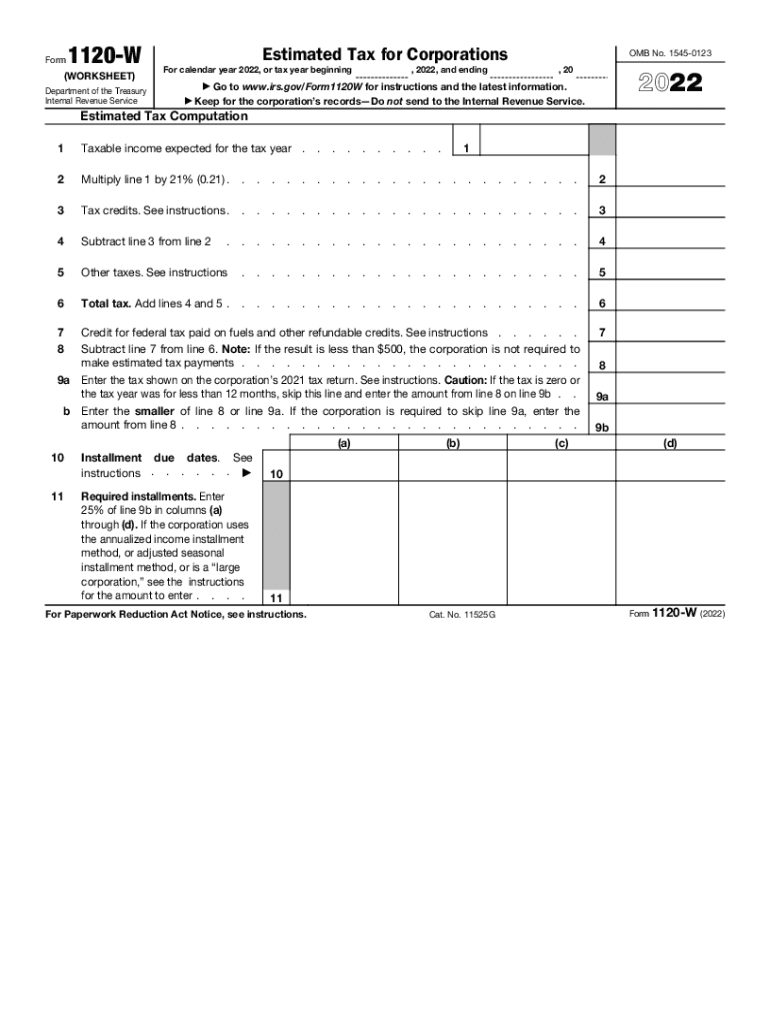

IRS 1120-W 2022-2026 free printable template

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

How to fill out IRS 1120-W

Latest updates to IRS 1120-W

All You Need to Know About IRS 1120-W

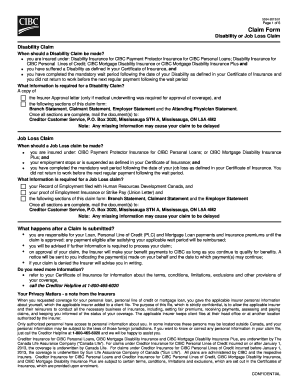

What is IRS 1120-W?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120-W

What should I do if I realize I've made a mistake on my IRS 1120-W after submission?

If you discover a mistake after submitting your IRS 1120-W, you can amend your form. To do this, you will need to file a corrected version of the form, clearly indicating the changes made. Keep in mind that it's best to address errors as soon as possible to avoid potential penalties.

How can I verify if my IRS 1120-W e-file submission was received by the IRS?

You can verify the receipt of your IRS 1120-W e-file submission by using the IRS e-file status tool available on their website. This tool allows you to track the status of your submission, ensuring that it has been successfully accepted or providing details if it was rejected.

What should I do if my IRS 1120-W e-filing gets rejected?

In the event that your IRS 1120-W e-filing is rejected, carefully review the rejection notice for the specific reason. Common issues include incorrect information or format errors. Correct the errors accordingly and resubmit your form to the IRS for processing.

Are there specific technical requirements I need to consider when e-filing the IRS 1120-W?

Yes, when e-filing the IRS 1120-W, it's important to ensure that your software meets the IRS's technical requirements. Verify compatibility with your browser or device, and make sure that you're using an updated version of your e-filing software to avoid any technical difficulties during submission.

What steps should I take if I receive a notice from the IRS regarding my IRS 1120-W?

Upon receiving a notice from the IRS about your IRS 1120-W, carefully read the correspondence to understand the issue at hand. Prepare any necessary documentation to respond, and follow the instructions provided in the notice to rectify the situation or appeal if needed.

See what our users say